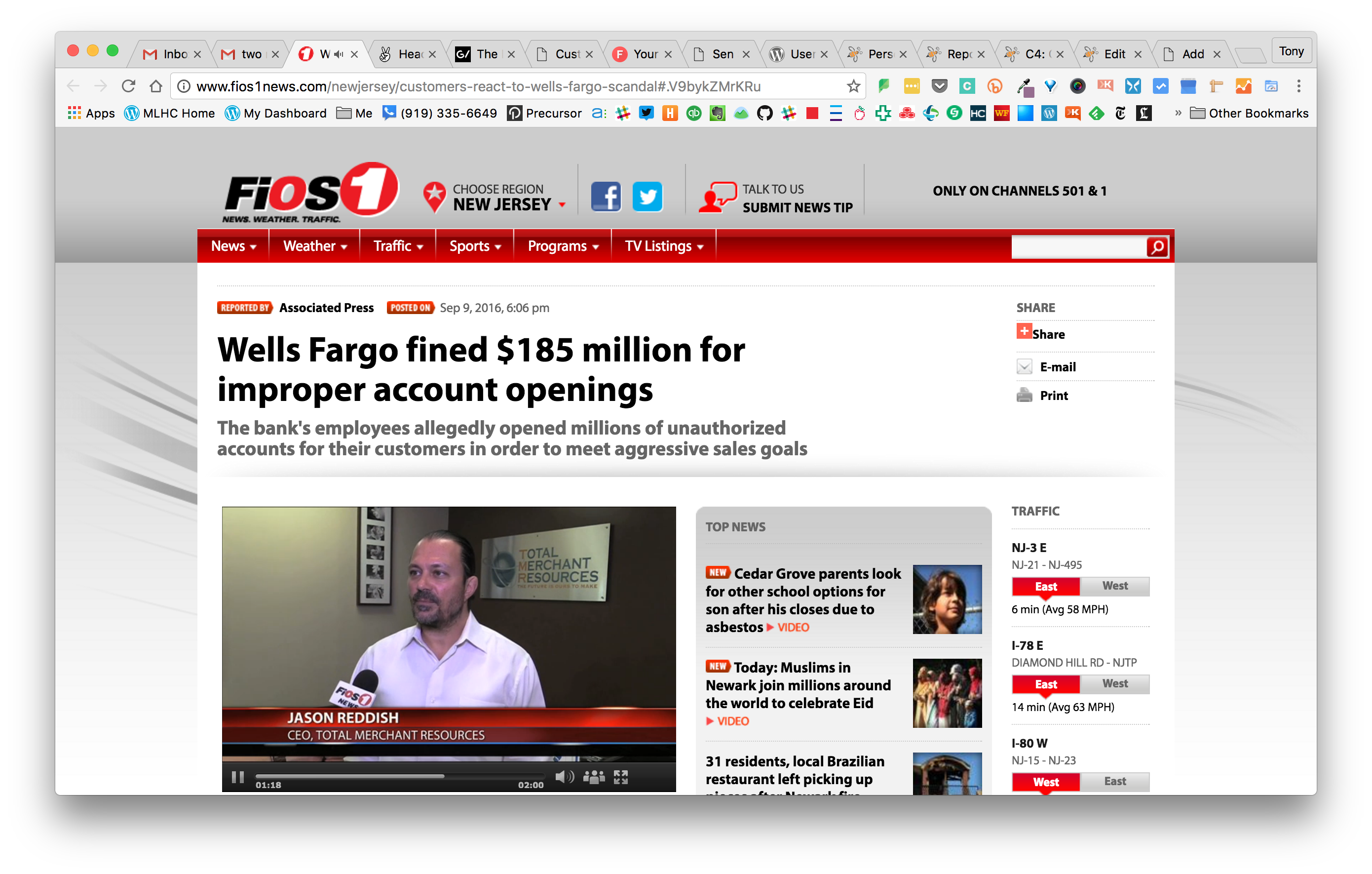

Total Merchant Resources CEO, Jason Reddish, was interviewed by FIOS1 TV about what Wells Fargo customers affected by improper account opening by Wells Fargo employees to meet sales targets are going to need to do to ensure their credit is not affected by the scandal.

“It was an unauthorized account that was open,” said Reddish. “So, technically it should affect the person’s credit. The problem is proving that…and proving that with the credit bureau is going to be very tedious and could take some time.”

Jason was asked how the $180M fine (currently the largest fine the Consumer Financial Protection Bureau has levied against a financial institution) would affect Wells Fargo.

“It’s a slap on the wrist,” he said. “It’s like Goldman Sachs a couple of months ago. They pay money and they move on.”

Read the full story and watch the video here.